Common application integrations and integration options for Oracle Cloud ecosystem

Cloud is now a key component of the IT stack that connects the enterprise. The IT savvy companies are shifting to cloud and moving their internal systems to the new cloud-based ecosystem. The ERP vendors are not staying behind in this evolution. They have now come with the cloud version of their software and offer it in a SaaS model. The companies are getting inclined towards sourcing SaaS services more and more to achieve simplified data flow, minimize complexity, and improve operational efficiency. Oracle ERP has also come up with cloud version of its various modules: HCM, Finance, Payroll, Order Management, Procurement, etc.

The needs of the new ecosystem

SaaS based solutions like Oracle ERP are changing the IT landscape for a while now. Many emerging companies are harvesting value from it. However, the cloud ecosystem has the same need as the on-prem systems. It needs to talk to other systems and third-party applications for seamless data exchange.

The biggest challenge is integrating the legacy systems to SaaS based systems as the companies’ IT architecture has been built decades ago. There is also a need for one SaaS service to talk to another SaaS service. While a SaaS based system provides a great value, the IT is now tasked with enabling integrations with other SaaS systems as well as Legacy systems.

” While a SaaS based system provides a great value, the IT is now tasked with enabling integrations with other SaaS systems as well as Legacy systems. “

Key Oracle Clouds and Integrations

If a business uses Oracle SaaS applications, it must integrate it with other applications as well for a seamless interaction between different business components. Oracle ERP Cloud offers various modules for different business functionality across Finance, Supply Chain Management (SCM), Human Capital Management (HCM), Payroll, Order Management, and Procurement. Oracle ERP Cloud Adapter is used to connect to Oracle Cloud ERP to other applications. It allows easy integration of on-prem or SaaS applications with Oracle ERP Cloud without getting into the specifications involved in integration.

Below are a few key integrations that Oracle SaaS applications often use:

Oracle Supply Chain Management (SCM) Cloud

Key SCM business events are: Inventory Management, Maintenance, Manufacturing, Order Management, Product Lifecycle Management, Procurement, and Supply Chain Collaboration and Visibility. Oracle ERP Cloud Adapter allows easy integration with online apps, points of sale (POS), and digital assistants such as ChatBot. This simplifies the process of reaching out to finance and operations data and streamline repetitive tasks.

Oracle Human Capital Management (HCM) Cloud

The Oracle ERP Cloud Adapter allows easy integration of on-prem and other SaaS based HR applications with Oracle HCM Cloud without having any knowledge on the specs involved in the integration. Oracle HCM cloud integrates with ADP Global Payroll and uses ADP Global Payroll interface to source salary and earnings details of employees in a specified format. Time clock integration is used to track employee’s attendance and effort for a chosen period.

Oracle Cloud Financials

Oracle Cloud Financials provides decision-enabling insights into a company’s financial position and offers tailored solution for business organizations of every size. The cloud platform harmonizes accounting processes from multiple ERP and transactional systems and offers host-to-host integrations with Banks for uninterrupted payment transactions with trading community. Oracle Cloud Financials module helps companies to make informed business decisions using intuitive data visualization and graphical insights of financial information.

” Oracle ERP Cloud Adapter allows easy integration of on-prem or SaaS applications with Oracle ERP Cloud without getting into the specifications involved in integration. “

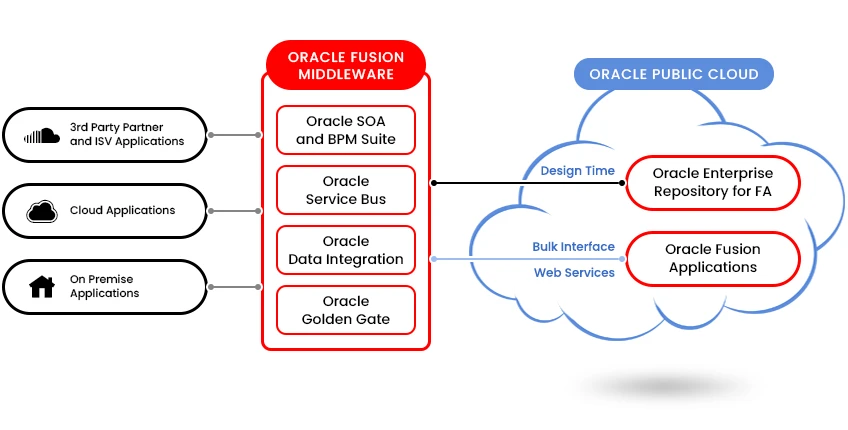

Integration with middleware

Oracle Integration Cloud (OIC) is a fully managed service that allows companies to integrate on-prem, cloud or both applications, automate operations, create visual applications, and gain insights into business processes.

Talend Cloud is a complete end-to-end data integration and management platform, designed to allow business and IT to work together to deliver trusted data throughout their organization.

MuleSoft, Oracle’s partner, offers a hybrid integration platform that can be deployed on-premises, on the cloud, or both. It is a scalable runtime engine for integrations, APIs, and microservices.

Simple Object Access Protocol (SOAP) Web Services integrate external applications with Oracle ERP Cloud for the credit-to-cash business process. The Oracle Cloud Infrastructure APIs are typical REST APIs that use HTTPS requests and responses. Oracle REST APIs are used to view and manage data stored in Oracle Financials Cloud.

Electronic Data Interchange (EDI) manages a set of data formats that are used to exchange formal business documents between companies. Oracle Cloud Integration provides support for B2B e-commerce with B2B for Oracle Integration. It Integrates application data to trading partners via EDI.

Oracle Universal Content Management (UCM) platform manages the entire spectrum of unstructured content in various formats such as documents, graphics, Web pages, scanned images, e-mail, and records. Oracle HCM cloud uses as its content management system. Files in various formats can be imported, exported and archived using UCM.

CES Accelerators

CES has extensive experience in Oracle Cloud integration and has built accelerators for integration as part of its Oracle SaaS solutions. Key features of CES accelerators are: reusable code, compatibility with various file formats, methodology for deployment, and cloud integration testing expertise.

CES brings in the best expertise and practices on Oracle Cloud integration services to seamlessly integrate existing and third party applications, automate operational processes, and extract real-time business metrics using dashboards. For more information or a conversation on how CES can help provide Oracle Cloud Integration services, contact us at sales@cesltd.com