Fund & Portfolio Accounting Services: A Comprehensive Managed Support that Improves Operational Alpha

Streamline and automate the back-office accounting processes by using the best KPO service provider

Challenges of running financial operations in an investment firm

The world of Financial Investments and investment management firms is maze of numbers and arithmetic. These firms continuously make and track financial transactions related to individual securities, funds and portfolios, and reports numbers to customers, shareholders, and authorities. This play of numbers involves people and paperwork, right from acquiring skilled human resources, legal experts and admins for handling the various levels of tasks such as billing, collections, payments, etc. to name a few. And it goes without saying that running these accounting operations with all the exacting paperwork can be highly demanding. In a nutshell, it requires firms to invest a huge dollar amount to run the accounting operations.

” Ploughing through heaps of accounting tasks can be like untangling mathematical noodles. “

When the top line stalls and the bottom line suffers

How much ever daunting the task may be, the firms still need to make a profit. Asset Management companies make their profits in three ways – increasing the number of customers, increasing the returns for those customers and thereby earning a good commission, and reducing expenses to improve operational alpha.

Operations related to financial transactions are categorized into various functions like accounting, tax filing, customer and regulatory reporting, and other administrative activities. Each of these functions perform complex activities that cost a significant time and money to any financial institution. Apart from the cost factor, inefficiencies in operations due to less experienced hands/unskilled resources may result in loss of precious time and unpredictable issues.

Helping Asset Managers focus on investment decisions

When the marketing is growing, the asset management firms generally get away with inefficient operations. When the growth in the top line stalls the focus is on improving profitability by reducing operational expenses. The pressure is on reducing cost, the cycle time for each activity, and most importantly acquiring skilled human resources.

There are several good companies that specialize in providing services in one or more of the above functions. However, there is hardly any firm in the market that offers the entire breadth and depth of services needed for a growth seeking asset management firm. And outsourcing sections of your financial operations to different vendors may not be a wise decision.

” Unskilled resources handling financial operations can cost the firm precious time and money. “

A comprehensive solution for financial operations from CES

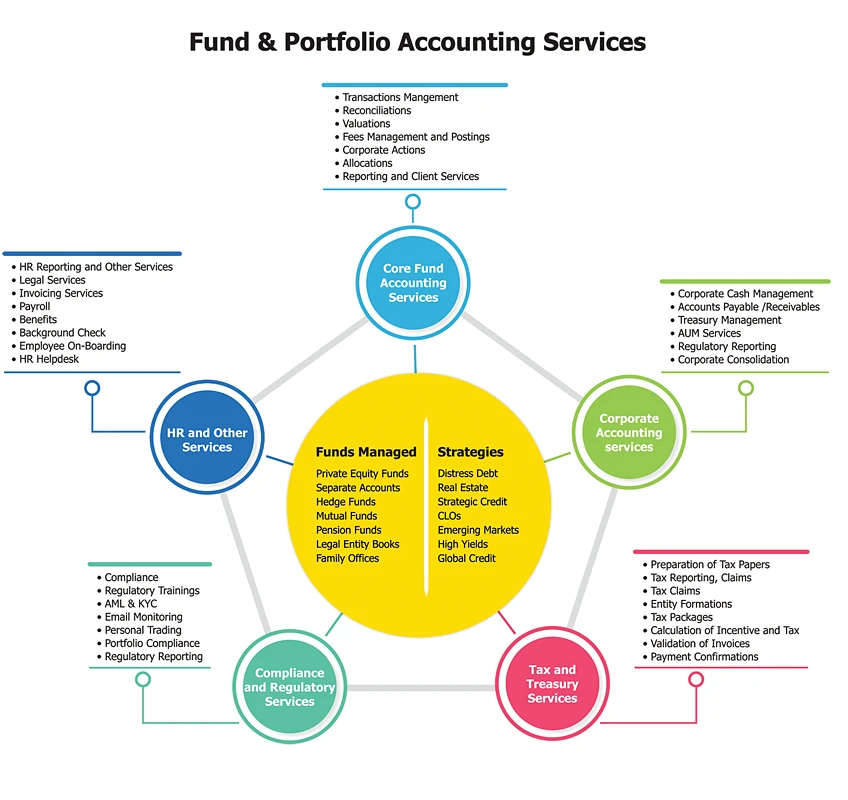

CES provides end-to-end Portfolio Management Support Solutions in a managed service model to Investment Management companies. We have the expertise in the operational requirements of a wide array of portfolios and investment vehicles that include:

- Private Equity Funds

- Separate Accounts

- Hedge Funds

- Mutual Funds

- Pension Funds

- Legal Entity Books

- Family Offices

The services offered are comprehensive including but not limited to:

- Portfolio and fund accounting services

- Corporate accounting

- Tax payments and filings

- Compliance and regulatory reporting

- Reconciliation

- Billing and Payments, etc.

With experience gathered from servicing for many years in the financial industry, CES is known for providing wholesome, quality, customizable, and automation-driven services while maintaining the privacy and security of data.

CES Portfolio Management support can significantly reduce inefficiencies in back-office processes leading to a higher operational alpha

Benefits of CES services

CES is equipped with trained resources who can handle all the elements of an asset management firm’s financial operations. As we work remotely our back-office services can reap great benefits for the firm in terms of cost savings. Our skilled workforce can significantly reduce the current operational inefficiencies in the firm ultimately leading to a higher operational alpha. Below are the offerings of CES:

- Scalable remote team

- Flexible pricing models

- Predictive cost forecasting

- Support of an IT team for automation opportunities

- Reduced administrative overhead and savings up to 50%

- When all the services are consumed as a bundle, it generates a significant Operational Alpha for the firm

Other services

Other services related to Managed Portfolio Accounting Support that CES offers to Investment Management companies include Internal control and SOX auditing, Data Management, and Cyber Security. For more information or a conversation on how CES can help make your business save cost and improve operational efficiency, please contact us at sales@cesltd.com. You may also be interested in the blog on our Compliance service: Checklists, Checkboxes, and Certifications: Compliance Service in a Box for Asset Managers.