Financial Clarity and Control: How Oracle EPM Leads the Way

Oracle Enterprise Performance Management (EPM) has revolutionized how businesses manage financial planning software, budgeting, consolidation, the close process, and reporting. As organizations evolve in a rapidly changing business environment, the need for a robust, integrated system to support these operations has never been more critical. Oracle EPM provides just that — offering solutions that enhance performance and improve decision-making.

In this blog post, we will explore the key features, benefits, and real-world impact of Oracle EPM solutions, explaining why it has become the go-to solution for many enterprises.

Oracle EPM Explained

Oracle EPM is a suite of integrated applications that help organizations manage financial planning, budgeting, forecasting, consolidation and close, reporting, and operational management. It supports integrated financial management by providing a unified platform that streamlines these processes, ensuring efficiency and accuracy. With features like real-time analytics, predictive forecasting, and collaborative tools, Oracle EPM empowers finance teams to make informed decisions.

Core Components of Oracle EPM

Oracle EPM solutions consist of purpose-built components that empower corporate finance teams to manage business processes effectively. This suite integrates financial management capabilities, streamlining budgeting, forecasting, and reporting.

Oracle EPBCS (Enterprise Planning and Budgeting Cloud Service): A central part of Oracle’s EPM suite, offering a cloud-based planning solution that enables businesses to create accurate financial plans and ensure consistent performance management. It provides a unified platform that integrates financial, operational, and strategic planning, supporting comprehensive performance management.

Oracle FCC (Financial Consolidation & Close): A cloud-based solution that automates and streamlines the financial consolidation and close process. It offers robust features for managing complex consolidations, eliminating manual processes, and ensuring compliance with global accounting standards. Oracle FCC allows finance teams to automate the collection, consolidation, and reporting of financial data, providing a faster and more accurate close process.

Oracle Narrative Reporting: A secure, cloud-based reporting solution that enables businesses to optimize the creation of comprehensive reports. Blending quantitative financial data with qualitative narratives, it supports decision-making process by providing context to financial data. Ideal for organizations requiring regular internal and external financial reporting, it eliminates inefficiencies associated with traditional reporting processes.

Oracle Workforce Planning: A comprehensive, cloud-based tool that allows organizations to integrate HR and finance data seamlessly, enabling them to plan, analyze, and streamline workforce resources. It helps companies align workforce planning with overall financial strategy, from headcount to cost and skills.

Oracle ARCS (Account Reconciliation): A cloud-based solution that automates and improves the reconciliation process. ARCS centralizes financial data reconciliation and helps organizations manage high volumes of reconciliations while minimizing risks and errors. Its automation features transform traditional manual reconciliation into a more controlled, auditable workflow.

Oracle EDM (Enterprise Data Management): This robust platform allows businesses to manage their enterprise data assets in a structured, consistent, and efficient manner. It enables organizations to govern and maintain their enterprise data, including reference data, master data, metadata, and hierarchies. With EDM, businesses can ensure that their data remains consistent, accurate, and aligned across various departments, applications, and systems.

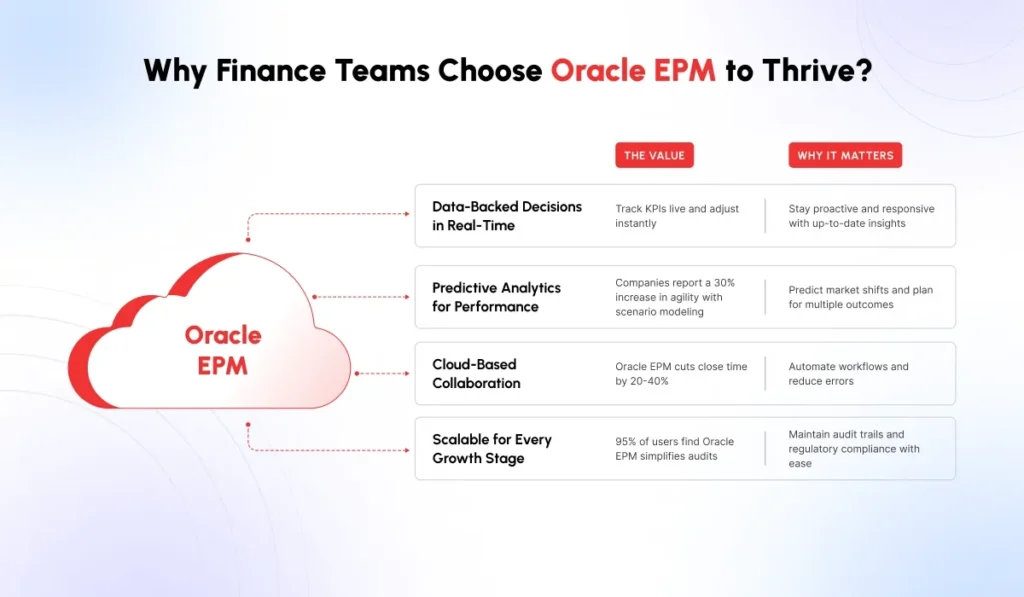

How Oracle EPM Powers Financial Success

Oracle EPM features strengthen core financial processes to improve accuracy, collaboration, and decision-making:

- Financial Planning and Budgeting: Simplifies the planning process with built-in templates and advanced modeling capabilities. Finance teams can create budgets more accurately and collaborate with different departments seamlessly.

- Automated Financial Consolidation: Oracle FCC automates complex consolidation processes, reducing errors and eliminating the need for manual interventions.

- Data Integration: Oracle EPM integrates financial and operational data from various systems, enabling a single source of truth. This integration allows for more accurate reporting and organizational consistency.

- Real-time Financial Reporting: One of the standout features of Oracle EPM is its ability to deliver real-time financial reports. This allows businesses to track performance and adjust strategies as needed.

- Scenario Modeling: With Oracle EPM, businesses can create different financial scenarios and assess potential outcomes. This predictive modeling helps leaders make data-driven decisions even in uncertain environments.

- Compliance and Audit Support: The platform supports regulatory compliance and auditing with automated workflows, documentation, and clear traceability of financial data.

Benefits of Implementing Oracle EPM

- Improved Decision Making: By offering real-time insights and analytics, Oracle EPM allows executives to make informed decisions quickly and efficiently.

- Increased Productivity: Automation of repetitive tasks such as reporting and budget tracking leads to significant time savings for finance teams. With cloud-based EPM tools, they can then focus on strategic initiatives rather than manual processes.

- Enhanced Collaboration: Oracle EPM fosters collaboration across teams with cloud-based tools that enable multiple users to work on the same data simultaneously.

- Scalability and Flexibility: Whether you’re a growing mid-sized company or a large enterprise, Oracle EPM scales with your business needs. Its modular structure allows for customization, making it a flexible solution for a variety of industries.

Real-World Use Cases: Oracle EPM in Action!

Reducing Budget Cycle Times

Many leading enterprises use Oracle EPM to streamline their financial processes. For example, a global manufacturing firm implemented Oracle EPM solutions to reduce the time it took to prepare and approve budgets, resulting in a 30% reduction in cycle times and improved alignment across departments.

Solving Multi-Currency Complexities for Multinationals

Global companies with operations in multiple countries face challenges in managing multiple currencies, varying accounting standards, and complex organizational structures. For instance, a multinational company implemented Oracle FCC to handle multi-currency consolidations and comply with both IFRS and local GAAP regulations, reducing their close cycle by 40%.

Enhancing Financial Health and Visibility

A healthcare organization leveraged Oracle EPM’s scenario planning to navigate regulatory changes and streamline resources, leading to improved overall financial health. Similarly, a large manufacturing company used Oracle FCC to optimize its financial close process, increasing visibility into financial data and consistently meeting tight regulatory deadlines.

Your Path to Financial Agility

Oracle EPM has transformed the way businesses approach financial management by providing them with a powerful suite of tools for planning, reporting, and analysis. With its cloud-based platform and integrated capabilities, Oracle EPM helps companies remain agile in today’s fast-paced market. Whether you’re looking to improve decision-making, enhance productivity, or achieve greater financial visibility, Oracle EPM offers the solutions your business needs.

Willing to transform your financial strategy? Reach out to learn how CES can help you acquire clarity, control, and lasting impact with Oracle EPM.

Authored by Andy Case, Vice President of EPM Practice