Daily Reconciliation for Cash and Positions helps maintain accurate books and records. The reconciliation process involves thorough verifications of each transaction and resolutions of any discrepancies. Accurate reconciliation builds trust, transparency, and accountability for back-office operations. In an industry where real-time financial data is imperative, and reconciliation is pivotal, it raises a vital question –

How can Asset Managers manage the demand for fast and accurate reconciliation?

Asset Managers need to reconcile their investments at regular intervals to rectify errors promptly and on a timely basis. Conducting daily bank reconciliation ensures records are up-to-date and accurate. The blog unveils how the CES CashTrax tool helps you automate complex reconciliation processes based on your business rules to improve accuracy and speed.

Behind the Scenes: A Closer Look at Reconciliation Processes

Even today, many asset management firms rely manually on Excel for their reconciliation activities.

Let us briefly review some of the reconciliation activities commonly undertaken:

- Cash Reconciliation: This reconciliation process involves comparing closing cash balances of Accounting Books with Custodians or Prime Brokers and preparing transaction-level reconciliations so that any exceptions reflecting on the reconciliation can be resolved promptly. This process can help departments estimate their cash flows and manage their cash to aid in investment decisions related to Short-Term Investment Funds (STIF) plans.

- Position Reconciliation: This process involves the reconciliation of the Invested quantities from two or more sources. This is also the process of confirming that an asset manager holds the same number of securities that the prime broker, custodian, or counterparty reflects in their books on the specified date.

- Trade Reconciliation: This involves comparing the records from the order management system (OMS) with the trades. Since a majority of asset managers post their daily transactions through an automated trade posting process, any failure in their trade posting process may lead to discrepancies in their books. Reconciliation of trades will help them find these discrepancies and post them quickly.

- Reconciliation Reporting: This includes reconciliation reports that comprise an in-depth overview of the process’s outcomes. This contains the summarized Currency-Wise Cash Balances, Matched Transactions, Unreconciled Transactions, comments for breaks, etc.

When these reconciliation processes rely on Excel, it leads to in-process issues such as version control problems, errors, and inconsistencies. These issues result in increased manual efforts, higher costs, and operational risks.

Breaking Free from Manual Reconciliation: AUTOMATE Asset

Asset management firms are turning to automated reconciliation software solutions to address these challenges. This helps decrease reliance on manual processes that are prone to errors and minimize associated risks. Here’s how an automated reconciliation tool can help asset managers and firms handle their operations efficiently:

- Significant Reduction in Manual Efforts: Automation eliminates time-consuming manual tasks and improves productivity.

- Automated Data Processing with Scheduler: Automated data processing using a scheduler streamlines daily operations, ensuring timely and systematic handling of tasks and reducing the risk of errors associated with manual execution.

- Dashboard View for Higher Management Visibility: The dashboard offers a clear overview of key metrics, facilitating quick and data-driven decision-making for management by presenting insightful information.

- Historical Reconciliation/Data Reports Availability: Access to historical reconciliation and data reports at any time enables easy reference for audits and analysis, helping with transparency and accountability in financial operations.

CES CashTrax: A Game-Changer that Automates Your Reconciliation for Seamless Operation

CashTrax is an innovative tool that helps you standardize, streamline, and automate reconciliation processes.

CashTrax is designed to manage reconciliations and provide efficient daily oversight of both trade and non-trade activities. With the ability to seamlessly transition from Microsoft Excel and traditional processes, the tool can automate data uploads, schedule the recon processes, and offer real-time visibility into the entire process. The tool’s turbo-matching engine can be configured to incorporate specific business rules. It provides real-time recon reports and closing balances within a predefined threshold as specified. Furthermore, the platform automatically downloads files from custodians and can also be integrated into accounting systems like Geneva.

A comprehensive overview of CashTrax Features:

- Rule-Based Turbo Matching: Utilizes rule-based matching with a focus on volume (>90%) and high accuracy (>99%).

- Break Management with Age Tracking: Manages breaks focusing on their age, facilitating efficient resolution.

- Flexible Reconciliation Options: Supports Multiple Funds Single Account or Multiple Funds Multiple Accounts Reconciliations.

- Auto Break Assignment: Automatically assigns breaks to specified users for streamlined resolution.

- Detailed Transaction Reports: Provides detailed reports by Transaction, Portfolio, or Account for comprehensive insights.

- Report Review and Publishing: Allows the review, publishing, and generation of ad hoc reports.

- Dynamic Report Regeneration: Generates reports multiple times, reflecting previous changes.

- Audit Trail and Real-Time Syncs: Maintains an audit trail and supports multiple real-time reconciliations and syncs in real-time.

- Manual Matching and Overriding: Offers the ability to perform manual matching and overriding when necessary.

- Currency Balances Display: Calculates and displays local and base currency cash balances on a specified date.

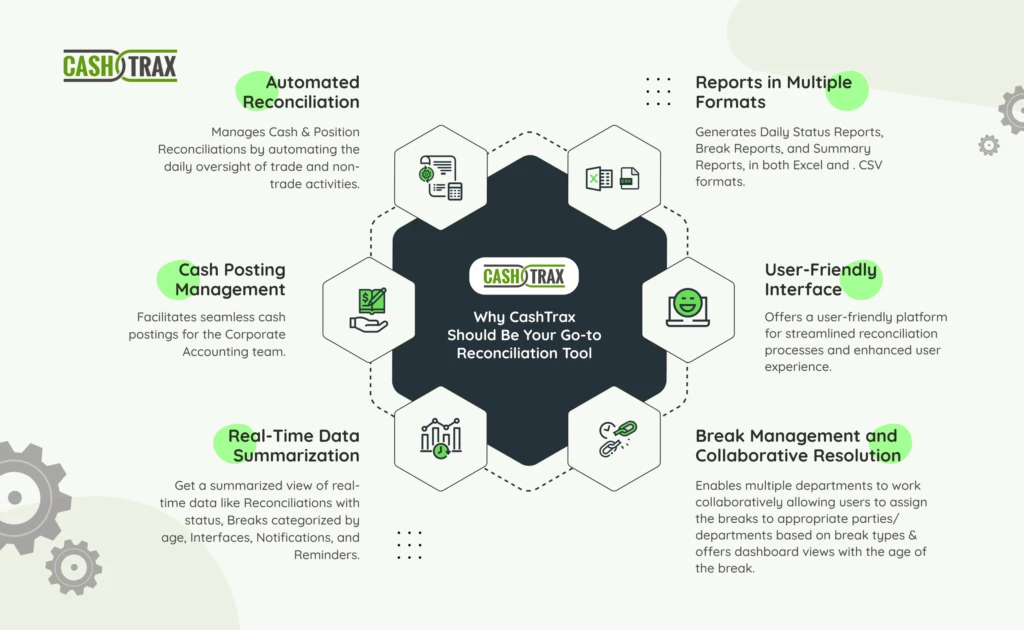

Why CashTrax Should Be Your Go-to Reconciliation Tool

Being a proactive reconciliation tool, CashTrax follows a pre-emptive approach to managing breaks as and when they occur throughout the trade lifecycle. There is a wide array of benefits CashTrax delivers –

- Automated Reconciliation: Manages Cash and Position reconciliations efficiently, automating the daily oversight of trade and non-trade activities.

- Real-time Data Summarization: Provides a summarized view of real-time data, including Reconciliations with status, Breaks categorized by age, Interfaces, Notifications, and Reminders.

- Break Management and Collaborative Resolution: Allows users to assign the breaks to appropriate parties/ departments based on break types and offers dashboard views with the age of the break, enabling multiple departments to work collaboratively. These assigned reconciliation summaries, i.e., also termed internal reports, help with effective resource allocation and communication across departments.

- Reports in Multiple Formats: Enables the generation of Daily Status Reports, Break Reports, and Summary Reports, available in both Excel and . CSV formats.

- Cash Posting Management: Supports Corporate Accounting teams by facilitating seamless cash postings.

- User-Friendly Interface: Offers a user-friendly platform for streamlined reconciliation processes and enhanced user experience.

Automation is no longer a convenience but a necessity for precision and speed. With CashTrax, asset managers can streamline and automate their reconciliation process that is fast, accurate, and comprehensive.

Get rid of tedious manual data entry and say goodbye to spreadsheet hassles. Request a demo at sales@cesltd.com.